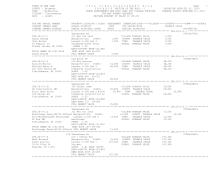

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 19

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2016

VILLAGE - Fleischmanns

TAX MAP NUMBER SEQUENCE

SWIS - 124601

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 287.14-2-10 ****************

Breezy Hill Rd

07802722001

287.14-2-10

280 Res Multiple

VILLAGE TAXABLE VALUE

212,800

Breezy Road LLC

Margaretville 124601 23,400 COUNTY TAXABLE VALUE

212,800

Attn: Joseph Heller Armstrong Gl8 Lot 35 212,800 TOWN TAXABLE VALUE

212,800

1303 53rd St Ste 216 Yarot Devash LLC

SCHOOL TAXABLE VALUE

212,800

Brooklyn, NY 11219 FRNT 350.00 DPTH 115.00

ACRES 0.78

PRIOR OWNER ON 3/01/2016 EAST-0485738 NRTH-1210839

Breezy Road LLC

DEED BOOK 1476 PG-111

FULL MARKET VALUE

212,800

******************************************************************************************************* 287.14-2-11 ****************

133 Breezy Hill Rd

07802729001

287.14-2-11

210 1 Family Res

VILLAGE TAXABLE VALUE

119,700

Meth Jack

Margaretville 124601 15,000 COUNTY TAXABLE VALUE

119,700

Meth Rachelle

Armstrong Gl8 Lot 35 119,700 TOWN TAXABLE VALUE

119,700

135-04 72 Ave

Simpson

SCHOOL TAXABLE VALUE

119,700

Flushing, NY 11367 ACRES 0.38

EAST-0485795 NRTH-1211078

DEED BOOK 825 PG-181

FULL MARKET VALUE

119,700

******************************************************************************************************* 287.14-3-1 *****************

54 Breezy Hill Rd

07802611001

287.14-3-1

210 1 Family Res

VILLAGE TAXABLE VALUE

230,200

Bennett Allison J Margaretville 124601 15,700 COUNTY TAXABLE VALUE

230,200

352 W 115th St Apt 4W Armstrong Gl8 Lot 35 230,200 TOWN TAXABLE VALUE

230,200

New York, NY 10026-2647 Pasternak

SCHOOL TAXABLE VALUE

230,200

ACRES 0.46 BANK 140330

EAST-0485773 NRTH-1210641

DEED BOOK 979 PG-108

FULL MARKET VALUE

230,200

******************************************************************************************************* 287.14-3-2 *****************

Switzerland Ave

07802635001

287.14-3-2

311 Res vac land

VILLAGE TAXABLE VALUE

13,300

Schlafrig Elke

Margaretville 124601 13,300 COUNTY TAXABLE VALUE

13,300

568 Grand St Apt 204 Armstrong Gl8 Lot 35 13,300 TOWN TAXABLE VALUE

13,300

New York, NY 10002 Hacknauer

SCHOOL TAXABLE VALUE

13,300

ACRES 1.60

EAST-0485941 NRTH-1210887

DEED BOOK 1072 PG-90

FULL MARKET VALUE

13,300

******************************************************************************************************* 287.14-3-3 *****************

Breezy Hill Rd

07802723001

287.14-3-3

311 Res vac land

VILLAGE TAXABLE VALUE

200

Breezy Road LLC

Margaretville 124601

200 COUNTY TAXABLE VALUE

200

Attn: Joseph Heller Armstrong Gl8 Lot 35

200 TOWN TAXABLE VALUE

200

1303 53rd St Ste 216 Yarot Devash LLC

SCHOOL TAXABLE VALUE

200

Brooklyn, NY 11219 FRNT 66.00 DPTH 16.50

EAST-0485862 NRTH-1210995

PRIOR OWNER ON 3/01/2016 DEED BOOK 1476 PG-111

Breezy Road LLC

FULL MARKET VALUE

200

************************************************************************************************************************************