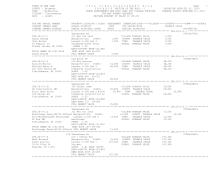

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 17

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2016

VILLAGE - Fleischmanns

TAX MAP NUMBER SEQUENCE

SWIS - 124601

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 287.13-2-35 ****************

Lt Red Kill Rd

07834198001

287.13-2-35

311 Res vac land

VILLAGE TAXABLE VALUE

2,200

Mathiesen Deborah Margaretville 124601 2,200 COUNTY TAXABLE VALUE

2,200

106 Lt Red Kill Rd Armstrong Gl8 L-25 2,200 TOWN TAXABLE VALUE

2,200

Fleischmanns, NY 12430 Levesque

SCHOOL TAXABLE VALUE

2,200

FRNT 95.00 DPTH 69.00

ACRES 0.14 BANK 4325

EAST-0483579 NRTH-1210986

DEED BOOK 1122 PG-118

FULL MARKET VALUE

2,200

******************************************************************************************************* 287.14-2-1 *****************

1077 Main St

07802604001

287.14-2-1

210 1 Family Res

VILLAGE TAXABLE VALUE

264,800

Costa Joan

Margaretville 124601 28,600 COUNTY TAXABLE VALUE

264,800

General Delivery

Armstrong Gl8 Lot 35 264,800 TOWN TAXABLE VALUE

264,800

Fleischmanns, NY 12430 Albany Savings Bank Fsb

SCHOOL TAXABLE VALUE

264,800

ACRES 6.84

EAST-0485031 NRTH-1210962

DEED BOOK 873 PG-290

FULL MARKET VALUE

264,800

******************************************************************************************************* 287.14-2-2 *****************

1103 Main St

07802567001

287.14-2-2

481 Att row bldg

VILLAGE TAXABLE VALUE

100,700

Warfield Patricia Margaretville 124601 13,700 COUNTY TAXABLE VALUE

100,700

Warfield Robert

Armstrong Gl8 Lot 35 100,700 TOWN TAXABLE VALUE

100,700

824 Rte 1

Peretta

SCHOOL TAXABLE VALUE

100,700

Halcott Center, NY 12430 FRNT 36.00 DPTH 84.00

EAST-0484719 NRTH-1210616

DEED BOOK 1132 PG-94

FULL MARKET VALUE

100,700

******************************************************************************************************* 287.14-2-3 *****************

Main St

07802555001

287.14-2-3

481 Att row bldg

VILLAGE TAXABLE VALUE

112,400

Stimmel Jerry

Margaretville 124601 14,900 COUNTY TAXABLE VALUE

112,400

Freedman Debra

Armstrong Gl8 Lot 35 112,400 TOWN TAXABLE VALUE

112,400

1843 E 32nd St

County Of Delaware

SCHOOL TAXABLE VALUE

112,400

Brooklyn, NY 11234 Bk1438Pg104BoundayAgreeme

ACRES 0.11

EAST-0484815 NRTH-1210637

DEED BOOK 747 PG-354

FULL MARKET VALUE

112,400

******************************************************************************************************* 287.14-2-4 *****************

1121 Main St

07802724001

287.14-2-4

481 Att row bldg

VILLAGE TAXABLE VALUE

67,300

Hoeko John N

Margaretville 124601 12,900 COUNTY TAXABLE VALUE

67,300

Adami Rita C

Armstrong Gl8 Lot 35 67,300 TOWN TAXABLE VALUE

67,300

PO Box 735

Spillman&Mendelsohn

SCHOOL TAXABLE VALUE

67,300

Fleischmanns, NY 12430 FRNT 29.00 DPTH 64.00

EAST-0484834 NRTH-1210597

DEED BOOK 1438 PG-104

FULL MARKET VALUE

67,300

************************************************************************************************************************************