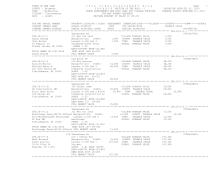

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 22

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2016

VILLAGE - Fleischmanns

TAX MAP NUMBER SEQUENCE

SWIS - 124601

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 287.14-3-10.2 **************

154 Switzerland Ave

07882358701

287.14-3-10.2

210 1 Family Res

VILLAGE TAXABLE VALUE

106,500

Hrazanek William

Margaretville 124601 14,100 COUNTY TAXABLE VALUE

106,500

PO Box 43

Armstrong Gl8 Lot 34 106,500 TOWN TAXABLE VALUE

106,500

Fleischmanns, NY 12430 County of Delaware

SCHOOL TAXABLE VALUE

106,500

ACRES 0.27 BANK 45

EAST-0486252 NRTH-1211601

DEED BOOK 1263 PG-153

FULL MARKET VALUE

106,500

******************************************************************************************************* 287.14-3-11.1 **************

470 Lake St

07802515001

287.14-3-11.1

210 1 Family Res

STAR BASIC 41854 0

0 0 30,000

Cherry Craig R

Margaretville 124601 27,100 VILLAGE TAXABLE VALUE

147,200

PO Box 614

Armstrong Gl8 Lot 34 147,200 COUNTY TAXABLE VALUE

147,200

Fleischmanns, NY 12430 Cherry

TOWN TAXABLE VALUE

147,200

ACRES 4.00

SCHOOL TAXABLE VALUE

117,200

EAST-0486909 NRTH-1212198

DEED BOOK 1128 PG-241

FULL MARKET VALUE

147,200

******************************************************************************************************* 287.14-3-11.2 **************

Lake St

287.14-3-11.2

314 Rural vac<10

VILLAGE TAXABLE VALUE

10,500

Samaniego Ivonne E Margaretville 124601 10,500 COUNTY TAXABLE VALUE

10,500

67-40 Yellowstone Blvd 5N Split #11 of 2006

10,500 TOWN TAXABLE VALUE

10,500

Forest Hills, NY 11375 Cherry

SCHOOL TAXABLE VALUE

10,500

ACRES 1.00 BANK 4333

EAST-0486791 NRTH-1212510

DEED BOOK 1122 PG-189

FULL MARKET VALUE

10,500

******************************************************************************************************* 287.14-3-12 ****************

400 Lake St

07802646001

287.14-3-12

414 Hotel

VILLAGE TAXABLE VALUE

839,900

Oppenheimers Hotel CORP Margaretville 124601

61,400 COUNTY TAXABLE VALUE

839,900

Attn: Regis Hotel Armstrong Gl8 L-34-35 839,900 TOWN TAXABLE VALUE

839,900

PO Box 700

ACRES 9.20

SCHOOL TAXABLE VALUE

839,900

Fleischmanns, NY 12430 EAST-0486869 NRTH-1211343

DEED BOOK 536 PG-447

FULL MARKET VALUE

839,900

******************************************************************************************************* 287.14-3-13 ****************

Lake St

07802689001

287.14-3-13

314 Rural vac<10

VILLAGE TAXABLE VALUE

300

Turet Diana

Margaretville 124601

300 COUNTY TAXABLE VALUE

300

Attn: Suzanne Klein Armstrong Gl#8 L34-35

300 TOWN TAXABLE VALUE

300

1 Renaissance Sq 23E Schumer St Regis Hotel

SCHOOL TAXABLE VALUE

300

White Plains, NY 10601 FRNT 60.00 DPTH 45.00

EAST-0486615 NRTH-1211192

DEED BOOK 536 PG-452

FULL MARKET VALUE

300

************************************************************************************************************************************