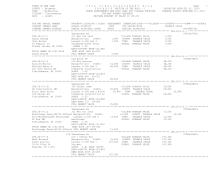

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 21

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2016

VILLAGE - Fleischmanns

TAX MAP NUMBER SEQUENCE

SWIS - 124601

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 287.14-3-7.2 ***************

162 Switzerland Ave

07845598201

287.14-3-7.2

210 1 Family Res

VILLAGE TAXABLE VALUE

99,000

Dombroski Gregory B Margaretville 124601 15,500 COUNTY TAXABLE VALUE

99,000

Dombroski Linda A Gl#8 Lot 34

99,000 TOWN TAXABLE VALUE

99,000

6 Queens Way

Thuss

SCHOOL TAXABLE VALUE

99,000

Newburgh, NY 12550 ACRES 0.44

EAST-0486175 NRTH-1211640

DEED BOOK 1001 PG-91

FULL MARKET VALUE

99,000

******************************************************************************************************* 287.14-3-7.3 ***************

Off Switzerland Ave

07852988301

287.14-3-7.3

311 Res vac land

VILLAGE TAXABLE VALUE

6,400

Dombroski Gregory B Margaretville 124601 6,400 COUNTY TAXABLE VALUE

6,400

Dombroski Linda A Armstrong Gl8 L-34 6,400 TOWN TAXABLE VALUE

6,400

6 Queens Way

Thuss

SCHOOL TAXABLE VALUE

6,400

Newburgh, NY 12550 ACRES 0.40

EAST-0486046 NRTH-1211675

DEED BOOK 1001 PG-91

FULL MARKET VALUE

6,400

******************************************************************************************************* 287.14-3-8 *****************

194 Switzerland Ave

07802087001

287.14-3-8

210 1 Family Res

VILLAGE TAXABLE VALUE

69,000

Uphill Cottages INC Margaretville 124601 15,700 COUNTY TAXABLE VALUE

69,000

PMB 272

Armstrong Gl8 Lot 34 69,000 TOWN TAXABLE VALUE

69,000

543 Bedford Ave

Niclas

SCHOOL TAXABLE VALUE

69,000

Brooklyn, NY 11211 ACRES 0.46

EAST-0486213 NRTH-1211748

DEED BOOK 1046 PG-111

FULL MARKET VALUE

69,000

******************************************************************************************************* 287.14-3-9 *****************

216 Switzerland Ave

07845588201

287.14-3-9

210 1 Family Res

STAR BASIC 41854 0

0 0 30,000

Merwin Lucas V

Margaretville 124601 27,100 VILLAGE TAXABLE VALUE

120,300

PO Box 7

Gl#8 Lot 34

120,300 COUNTY TAXABLE VALUE

120,300

Fleischmanns, NY 12430 Merwin&Brady

TOWN TAXABLE VALUE

120,300

ACRES 4.00 BANK 4307

SCHOOL TAXABLE VALUE

90,300

EAST-0486188 NRTH-1212038

DEED BOOK 1427 PG-20

FULL MARKET VALUE

120,300

******************************************************************************************************* 287.14-3-10.1 **************

Switzerland Ave

07802607001

287.14-3-10.1

323 Vacant rural

VILLAGE TAXABLE VALUE

28,600

Slavin Jeffrey

Margaretville 124601 28,600 COUNTY TAXABLE VALUE

28,600

PO Box 277

Armstrong Gl8 L-34-35 28,600 TOWN TAXABLE VALUE

28,600

Fleischmanns, NY 12430 County of Delaware

SCHOOL TAXABLE VALUE

28,600

ACRES 10.80

EAST-0486564 NRTH-1211892

DEED BOOK 1459 PG-341

FULL MARKET VALUE

28,600

************************************************************************************************************************************