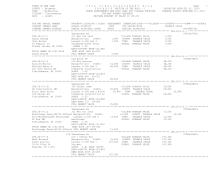

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 23

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2016

VILLAGE - Fleischmanns

TAX MAP NUMBER SEQUENCE

SWIS - 124601

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 287.14-3-14 ****************

128 Switzerland Ave

07802495001

287.14-3-14

210 1 Family Res

STAR BASIC 41854 0

0 0 30,000

McCann Michael H Sr Margaretville 124601 16,300 VILLAGE TAXABLE VALUE

121,900

McCann Jean

Armstrong Gl8 L-34-35 121,900 COUNTY TAXABLE VALUE

121,900

PO Box 15

Finch&Craft

TOWN TAXABLE VALUE

121,900

Fleischmanns, NY 12430 FRNT 135.80 DPTH 207.00 SCHOOL TAXABLE VALUE

91,900

ACRES 0.55

EAST-0486251 NRTH-1211471

DEED BOOK 1340 PG-152

FULL MARKET VALUE

121,900

******************************************************************************************************* 287.14-3-15 ****************

25 Switzerland Ave Ext

07802481001

287.14-3-15

210 1 Family Res

VILLAGE TAXABLE VALUE

69,300

Klapper Jacob

Margaretville 124601 12,600 COUNTY TAXABLE VALUE

69,300

Klapper Molly

Armstrong Gl8 Lot 35 69,300 TOWN TAXABLE VALUE

69,300

136-48 72 Ave

Ascher

SCHOOL TAXABLE VALUE

69,300

Flushing, NY 11367 FRNT 40.00 DPTH 94.50

ACRES 0.08

EAST-0486187 NRTH-1211395

DEED BOOK 659 PG-496

FULL MARKET VALUE

69,300

******************************************************************************************************* 287.14-3-16 ****************

Off Switzerland Ave

07802482001

287.14-3-16

311 Res vac land

VILLAGE TAXABLE VALUE

800

Klapper Jacob

Margaretville 124601

800 COUNTY TAXABLE VALUE

800

Klapper Molly

Armstrong Gl8 Lot 35

800 TOWN TAXABLE VALUE

800

136-48 72 Ave

Ascher

SCHOOL TAXABLE VALUE

800

Flushing, NY 11367 FRNT 40.00 DPTH 125.00

ACRES 0.15

EAST-0486301 NRTH-1211386

DEED BOOK 659 PG-496

FULL MARKET VALUE

800

******************************************************************************************************* 287.14-3-17 ****************

35 Switzerland Ave Ext

07802666001

287.14-3-17

270 Mfg housing

VILLAGE TAXABLE VALUE

33,500

Neumann Trust

Margaretville 124601 13,800 COUNTY TAXABLE VALUE

33,500

Attn: Carol Neumann Armstrong Gl8 Lot 35 33,500 TOWN TAXABLE VALUE

33,500

481 E 2nd St

Neumann

SCHOOL TAXABLE VALUE

33,500

Brooklyn, NY 11218 FRNT 100.00 DPTH 100.00

EAST-0486291 NRTH-1211320

DEED BOOK 1179 PG-346

FULL MARKET VALUE

33,500

************************************************************************************************************************************