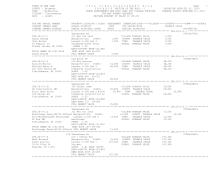

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 18

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2016

VILLAGE - Fleischmanns

TAX MAP NUMBER SEQUENCE

SWIS - 124601

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 287.14-2-5 *****************

27 Old Halcott Rd

07837948101

287.14-2-5

482 Det row bldg

VILLAGE TAXABLE VALUE

94,000

Mulloy John

Margaretville 124601 13,400 COUNTY TAXABLE VALUE

94,000

Zola Mulloy Gloria Armstrong Gl8 Lot 35 94,000 TOWN TAXABLE VALUE

94,000

PO Box 548

Walker

SCHOOL TAXABLE VALUE

94,000

Fleischmanns, NY 12430 FRNT 44.00 DPTH 64.00

EAST-0484868 NRTH-1210597

DEED BOOK 1372 PG-40

FULL MARKET VALUE

94,000

******************************************************************************************************* 287.14-2-6 *****************

21 Breezy Hill Rd

07802658001

287.14-2-6

418 Inn/lodge

VILLAGE TAXABLE VALUE

288,900

Congregation Saad VEzer Margaretville 124601

38,000 COUNTY TAXABLE VALUE

288,900

1303 53 St Apt 216 Armstrong Gl8 Lot 35 288,900 TOWN TAXABLE VALUE

288,900

Brooklyn, NY 11219 Schwartz Realty Corp

SCHOOL TAXABLE VALUE

288,900

ACRES 1.90

EAST-0485073 NRTH-1210700

DEED BOOK 1029 PG-60

FULL MARKET VALUE

288,900

******************************************************************************************************* 287.14-2-7 *****************

Breezy Hill Rd

07802512001

287.14-2-7

311 Res vac land

VILLAGE TAXABLE VALUE

21,200

Bistritzky Alexander Margaretville 124601 21,200 COUNTY TAXABLE VALUE

21,200

845 West End Ave

Armstrong Gl8 Lot 35 21,200 TOWN TAXABLE VALUE

21,200

New York, NY 10025 County Of Delaware

SCHOOL TAXABLE VALUE

21,200

ACRES 5.00

EAST-0485517 NRTH-1210950

DEED BOOK 682 PG-1061

FULL MARKET VALUE

21,200

******************************************************************************************************* 287.14-2-8 *****************

19 Breezy Hill Rd

07802556001

287.14-2-8

210 1 Family Res

VILLAGE TAXABLE VALUE

135,800

Safrin Jacob

Margaretville 124601 15,100 COUNTY TAXABLE VALUE

135,800

Safrin Shifra

Armstrong Gl8 Lot 35 135,800 TOWN TAXABLE VALUE

135,800

20 Bruck Ct

Duda

SCHOOL TAXABLE VALUE

135,800

Wesley Hills, NY 10977 ACRES 0.39 BANK 45

EAST-0485364 NRTH-1210633

DEED BOOK 1139 PG-48

FULL MARKET VALUE

135,800

******************************************************************************************************* 287.14-2-9 *****************

17 Breezy Hill Rd

07802706001

287.14-2-9

210 1 Family Res

VILLAGE TAXABLE VALUE

133,900

HHL Family Irrev Trust Margaretville 124601 19,200 COUNTY TAXABLE VALUE

133,900

Esther Schwarcz

Armstrong Gl8 Lot 35 133,900 TOWN TAXABLE VALUE

133,900

1430 43rd St Apt 3B Lowinger

SCHOOL TAXABLE VALUE

133,900

Brooklyn, NY 11219 ACRES 1.14

EAST-0485519 NRTH-1210638

DEED BOOK 952 PG-323

FULL MARKET VALUE

133,900

************************************************************************************************************************************