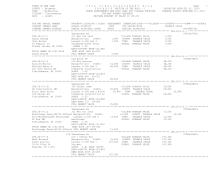

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 24

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2016

VILLAGE - Fleischmanns

TAX MAP NUMBER SEQUENCE

SWIS - 124601

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 287.14-3-18 ****************

Off Switzerland Ave

07802665001

287.14-3-18

311 Res vac land

VILLAGE TAXABLE VALUE

100

Neumann Trust

Margaretville 124601

100 COUNTY TAXABLE VALUE

100

Attn: Carol Neumann Armstrong Gl8 Lot 35

100 TOWN TAXABLE VALUE

100

481 E 2nd St

Neumann

SCHOOL TAXABLE VALUE

100

Brooklyn, NY 11218 FRNT 10.00 DPTH 100.00

EAST-0486236 NRTH-1211324

DEED BOOK 1179 PG-346

FULL MARKET VALUE

100

******************************************************************************************************* 287.14-3-19 ****************

104 Switzerland Ave

07802605001

287.14-3-19

210 1 Family Res

VILLAGE TAXABLE VALUE

92,700

Mark Kresic 2009 Liv Trust Margaretville 124601

14,000 COUNTY TAXABLE VALUE

92,700

Attn: Mark & Eva Kresic Armstrong Gl8 Lot 35 92,700 TOWN TAXABLE VALUE

92,700

805B Heritage Hills Kresic

SCHOOL TAXABLE VALUE

92,700

Somers, NY 10589

ACRES 0.26

EAST-0486172 NRTH-1211328

DEED BOOK 1253 PG-14

FULL MARKET VALUE

92,700

******************************************************************************************************* 287.14-3-20.1 **************

327 Old Halcott Rd

07802551001

287.14-3-20.1

417 Cottages

VILLAGE TAXABLE VALUE

258,800

Maple Hill Court INC Margaretville 124601 35,500 COUNTY TAXABLE VALUE

258,800

Attn: Abraham Schlafrig Armstrong Gl8 Lot 35 258,800 TOWN TAXABLE VALUE

258,800

4317 15th Ave

Finch

SCHOOL TAXABLE VALUE

258,800

Brooklyn, NY 11219 ACRES 1.45

EAST-0486216 NRTH-1211040

DEED BOOK 648 PG-15

FULL MARKET VALUE

258,800

******************************************************************************************************* 287.14-3-20.2 **************

40 Switzerland Ave

07886538601

287.14-3-20.2

210 1 Family Res

VILLAGE TAXABLE VALUE

131,000

Schick Frieda

Margaretville 124601 19,400 COUNTY TAXABLE VALUE

131,000

1721 49th St

Armstrong Gl8 Lot 35 131,000 TOWN TAXABLE VALUE

131,000

Brooklyn, NY 11204 Maple Hill Court Inc

SCHOOL TAXABLE VALUE

131,000

ACRES 1.18

EAST-0486351 NRTH-1211228

DEED BOOK 651 PG-64

FULL MARKET VALUE

131,000

******************************************************************************************************* 287.14-3-20.3 **************

Switzerland Ave Ext

07886548601

287.14-3-20.3

311 Res vac land

VILLAGE TAXABLE VALUE

500

Maple Hill Court INC Margaretville 124601

500 COUNTY TAXABLE VALUE

500

Attn: Abraham Schlafrig Armstrong Gl8 Lot 35

500 TOWN TAXABLE VALUE

500

4317 15th Ave

Finch

SCHOOL TAXABLE VALUE

500

Brooklyn, NY 11219 ACRES 0.09

EAST-0486363 NRTH-1211315

DEED BOOK 648 PG-15

FULL MARKET VALUE

500

************************************************************************************************************************************