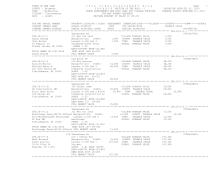

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 15

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2016

VILLAGE - Fleischmanns

TAX MAP NUMBER SEQUENCE

SWIS - 124601

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 287.13-2-25 ****************

973 Main St

07802628001

287.13-2-25

210 1 Family Res

VET COM T 41133 0

0 20,000

0

McClean Brendan

Margaretville 124601 15,000 STAR BASIC 41854 0

0 0 30,000

Mann Maxim

Armstrong Gl8 L-25-35 264,400 VILLAGE TAXABLE VALUE

264,400

PO Box 821

Dimond Est

COUNTY TAXABLE VALUE

264,400

Fleischmanns, NY 12430 ACRES 0.38

TOWN TAXABLE VALUE

244,400

EAST-0484059 NRTH-1210713 SCHOOL TAXABLE VALUE

234,400

DEED BOOK 1465 PG-288

FULL MARKET VALUE

264,400

******************************************************************************************************* 287.13-2-26 ****************

967 Main St

07802712001

287.13-2-26

283 Res w/Comuse

STAR BASIC 41854 0

0 0 30,000

Morales Martin

Margaretville 124601 12,600 VILLAGE TAXABLE VALUE

113,800

Morales Veronica

Armstrong Gl8 L-25-35 113,800 COUNTY TAXABLE VALUE

113,800

PO Box 929

Franklyn

TOWN TAXABLE VALUE

113,800

Fleischmanns, NY 12430 ACRES 0.08

SCHOOL TAXABLE VALUE

83,800

EAST-0484005 NRTH-1210673

DEED BOOK 1128 PG-246

FULL MARKET VALUE

113,800

******************************************************************************************************* 287.13-2-27 ****************

961 Main St

07802701001

287.13-2-27

220 2 Family Res

VILLAGE TAXABLE VALUE

60,900

Brennan Stephanie Margaretville 124601 12,900 COUNTY TAXABLE VALUE

60,900

PO Box 908

Armstrong Gl8 L-25 60,900 TOWN TAXABLE VALUE

60,900

Fleischmanns, NY 12430 Ernst

SCHOOL TAXABLE VALUE

60,900

FRNT 29.00 DPTH 106.00

ACRES 0.12

EAST-0483982 NRTH-1210719

DEED BOOK 1072 PG-188

FULL MARKET VALUE

60,900

******************************************************************************************************* 287.13-2-28 ****************

945 Main St

07802720001

287.13-2-28

210 1 Family Res

STAR BASIC 41854 0

0 0 30,000

Hernandez Victor R Margaretville 124601 14,000 VILLAGE TAXABLE VALUE

148,700

Hernandez Alma D

Armstrong Gl8 Lot 25 148,700 COUNTY TAXABLE VALUE

148,700

PO Box 543

Steltzer Est

TOWN TAXABLE VALUE

148,700

Fleischmanns, NY 12430 ACRES 0.25

SCHOOL TAXABLE VALUE

118,700

EAST-0483933 NRTH-1210735

DEED BOOK 1332 PG-262

FULL MARKET VALUE

148,700

******************************************************************************************************* 287.13-2-29 ****************

935 Main St

07802518001

287.13-2-29

210 1 Family Res

VILLAGE TAXABLE VALUE

179,100

Alverson Robert W Margaretville 124601 13,800 COUNTY TAXABLE VALUE

179,100

Weller Keith A

Armstrong Gl8 Lot 25 179,100 TOWN TAXABLE VALUE

179,100

2 Horatio St Apt 17J Ferraro

SCHOOL TAXABLE VALUE

179,100

New York, NY 10014 FRNT 55.00 DPTH 172.00

ACRES 0.23

EAST-0483859 NRTH-1210715

DEED BOOK 1032 PG-168

FULL MARKET VALUE

179,100

************************************************************************************************************************************