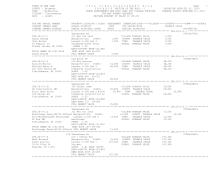

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 10

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2016

VILLAGE - Fleischmanns

TAX MAP NUMBER SEQUENCE

SWIS - 124601

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 287.13-1-26 ****************

140 Paradise Camp Rd

07829748001

287.13-1-26

210 1 Family Res

VILLAGE TAXABLE VALUE

249,500

Schneiderman David J Margaretville 124601 16,000 COUNTY TAXABLE VALUE

249,500

Rubin Anita

Gl 8 L 25

249,500 TOWN TAXABLE VALUE

249,500

PO Box 744

Bobrow

SCHOOL TAXABLE VALUE

249,500

Fleischmanns, NY 12430 ACRES 0.50

EAST-0483089 NRTH-0121108

DEED BOOK 596 PG-81

FULL MARKET VALUE

249,500

******************************************************************************************************* 287.13-1-27 ****************

Paradise Camp Rd

07829078001

287.13-1-27

311 Res vac land

VILLAGE TAXABLE VALUE

8,100

Sife Bud

Margaretville 124601 8,100 COUNTY TAXABLE VALUE

8,100

PO Box 311

Armstrong T L 25

8,100 TOWN TAXABLE VALUE

8,100

Fleischmanns, NY 12430 County of Delaware

SCHOOL TAXABLE VALUE

8,100

ACRES 0.52

EAST-0483198 NRTH-1210851

DEED BOOK 1356 PG-253

FULL MARKET VALUE

8,100

******************************************************************************************************* 287.13-2-1 *****************

106 Lt Red Kill Rd

07800978001

287.13-2-1

220 2 Family Res

STAR BASIC 41854 0

0 0 30,000

Mathiesen Deborah Margaretville 124601 12,700 VILLAGE TAXABLE VALUE

148,500

106 Lt Red Kill Rd Armstrong Gl#8 Lot 25 148,500 COUNTY TAXABLE VALUE

148,500

Fleischmanns, NY 12430 Levesque

TOWN TAXABLE VALUE

148,500

FRNT 142.00 DPTH 59.00 SCHOOL TAXABLE VALUE

118,500

ACRES 0.10 BANK 4325

EAST-0483565 NRTH-1211116

DEED BOOK 1122 PG-117

FULL MARKET VALUE

148,500

******************************************************************************************************* 287.13-2-2 *****************

224 Schneider Ave

07800746001

287.13-2-2

210 1 Family Res

VILLAGE TAXABLE VALUE

139,300

Grocholl Carl E

Margaretville 124601 16,600 COUNTY TAXABLE VALUE

139,300

PO Box 81

Armstrong T Gl8 L-25 139,300 TOWN TAXABLE VALUE

139,300

Fleischmanns, NY 12430 Grocholl Trust

SCHOOL TAXABLE VALUE

139,300

ACRES 0.62

EAST-0483679 NRTH-1211105

DEED BOOK 1469 PG-256

FULL MARKET VALUE

139,300

******************************************************************************************************* 287.13-2-3 *****************

25 Schneider Ave

07802650001

287.13-2-3

210 1 Family Res

VILLAGE TAXABLE VALUE

133,100

Osterhoudt Richard Paul Margaretville 124601

13,600 COUNTY TAXABLE VALUE

133,100

Short Meganne O

Armstrong Gl8 Lot 25 133,100 TOWN TAXABLE VALUE

133,100

91 Fox Ridge Rd

Osterhoudt/LifeUse

SCHOOL TAXABLE VALUE

133,100

Margaretville, NY 12455 FRNT 70.00 DPTH 120.00

ACRES 0.20

EAST-0483692 NRTH-1210989

DEED BOOK 739 PG-459

FULL MARKET VALUE

133,100

************************************************************************************************************************************