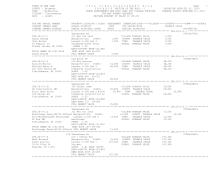

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 9

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2016

VILLAGE - Fleischmanns

TAX MAP NUMBER SEQUENCE

SWIS - 124601

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 287.13-1-22 ****************

55 Lt Red Kill Rd

07802717001

287.13-1-22

220 2 Family Res

VILLAGE TAXABLE VALUE

153,700

Giblin Michael P

Margaretville 124601 14,000 COUNTY TAXABLE VALUE

153,700

Giblin Vera E

Armstrong T Gl8 L-25 153,700 TOWN TAXABLE VALUE

153,700

14 Lincoln Ave

Graves

SCHOOL TAXABLE VALUE

153,700

Pomton Plains, NJ 07444 FRNT 70.00 DPTH 170.00

ACRES 0.26

EAST-0483470 NRTH-1210890

DEED BOOK 1205 PG-53

FULL MARKET VALUE

153,700

******************************************************************************************************* 287.13-1-23 ****************

99 Lt Red Kill Rd

07800008001

287.13-1-23

215 1 Fam Res w/

VILLAGE TAXABLE VALUE

97,800

O'Connell Kevin Margaretville 124601 12,700 COUNTY TAXABLE VALUE 97,800

O'Connell Sean Armstrong T Gl8 L-25 97,800 TOWN TAXABLE VALUE 97,800

252 Cumberland St Hespeler

SCHOOL TAXABLE VALUE

97,800

Brooklyn, NY 11205 FRNT 120.00 DPTH 102.00

ACRES 0.10

EAST-0483467 NRTH-1211102

DEED BOOK 700 PG-382

FULL MARKET VALUE

97,800

******************************************************************************************************* 287.13-1-24 ****************

Lt Red Kill Rd

07818877901

287.13-1-24

311 Res vac land

VILLAGE TAXABLE VALUE

100

Davis Thomas D

Margaretville 124601

100 COUNTY TAXABLE VALUE

100

Attn: Diane Davis Armstrong T Gl8 L-25

100 TOWN TAXABLE VALUE

100

215 Romeo Rd

Hemendinger

SCHOOL TAXABLE VALUE

100

Rochester, MI 48307 ACRES 0.01

EAST-0483458 NRTH-1211175

DEED BOOK 713 PG-632

FULL MARKET VALUE

100

******************************************************************************************************* 287.13-1-25.1 **************

Paradise Camp Rd

07802682001

287.13-1-25.1

311 Res vac land

VILLAGE TAXABLE VALUE

11,000

BOBMIR 33 LLC

Margaretville 124601 11,000 COUNTY TAXABLE VALUE

11,000

PO Box 744

Armstrong Gl8 Lot 25 11,000 TOWN TAXABLE VALUE

11,000

Fleischmanns, NY 12430 Herzberg

SCHOOL TAXABLE VALUE

11,000

ACRES 1.10

EAST-0483263 NRTH-1211074

DEED BOOK 1469 PG-238

FULL MARKET VALUE

11,000

******************************************************************************************************* 287.13-1-25.2 **************

83 Lt Red Kill Rd

287.13-1-25.2

311 Res vac land

VILLAGE TAXABLE VALUE

8,000

Castillo Alexander Margaretville 124601 8,000 COUNTY TAXABLE VALUE

8,000

Vega Michael A

County of Delaware 8,000 TOWN TAXABLE VALUE

8,000

Boulevard Sta

ACRES 0.50

SCHOOL TAXABLE VALUE

8,000

PO Box 131

EAST-0483456 NRTH-1210996

Bronx, NY 10459

DEED BOOK 1072 PG-298

FULL MARKET VALUE

8,000

************************************************************************************************************************************