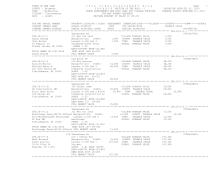

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 8

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

THESE ASSESSMENTS ARE ALSO USED FOR VILLAGE PURPOSES TAXABLE STATUS DATE-MAR 01, 2016

VILLAGE - Fleischmanns

TAX MAP NUMBER SEQUENCE

SWIS - 124601

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE-----VILLAGE------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 287.13-1-15.1 **************

843 Main St

07802532001

287.13-1-15.1

220 2 Family Res

VILLAGE TAXABLE VALUE

165,800

Fleischmanns D&R Ent LLC Margaretville 124601

18,400 COUNTY TAXABLE VALUE

165,800

Attn: Pasternak

Laussat Gl8 Lot 105 165,800 TOWN TAXABLE VALUE

165,800

325 Howard Ave

Nagy&Barabas

SCHOOL TAXABLE VALUE

165,800

Fairlawn, NJ 07410 ACRES 0.97

EAST-0483304 NRTH-1210799

DEED BOOK 1197 PG-218

FULL MARKET VALUE

165,800

******************************************************************************************************* 287.13-1-15.2 **************

815 Main St

07877748501

287.13-1-15.2

210 1 Family Res

STAR ENHAN 41834 0

0 0 65,300

Mojer Gwendolyn E Margaretville 124601 13,500 VILLAGE TAXABLE VALUE

88,500

PO Box 895

Lausette T Lot 105 88,500 COUNTY TAXABLE VALUE

88,500

Fleischmanns, NY 12430 Lacher

TOWN TAXABLE VALUE

88,500

FRNT 55.00 DPTH 130.00 SCHOOL TAXABLE VALUE

23,200

ACRES 0.19

EAST-0483193 NRTH-1210725

DEED BOOK 663 PG-906

FULL MARKET VALUE

88,500

******************************************************************************************************* 287.13-1-19 ****************

11 Lt Red Kill Rd

07802680001

287.13-1-19

411 Apartment

VILLAGE TAXABLE VALUE

126,600

Freedman Debra

Margaretville 124601 18,000 COUNTY TAXABLE VALUE

126,600

Stimmel Jerry

Lausat105-Armstrg L25 126,600 TOWN TAXABLE VALUE

126,600

1843 E 32nd St

Brecher

SCHOOL TAXABLE VALUE

126,600

Brooklyn, NY 11234 ACRES 0.22

EAST-0483393 NRTH-1210699

DEED BOOK 771 PG-110

FULL MARKET VALUE

126,600

******************************************************************************************************* 287.13-1-20 ****************

21 Lt Red Kill Rd

07802558001

287.13-1-20

210 1 Family Res

VILLAGE TAXABLE VALUE

146,100

Stimmel Jerry I

Margaretville 124601 14,100 COUNTY TAXABLE VALUE

146,100

Freedman Debra

Armstrong T Lot 25 146,100 TOWN TAXABLE VALUE

146,100

1843 E 32nd St

FRNT 75.00 DPTH 140.00 SCHOOL TAXABLE VALUE

146,100

Brooklyn, NY 11234 ACRES 0.27 BANK 45

EAST-0483408 NRTH-1210762

DEED BOOK 705 PG-606

FULL MARKET VALUE

146,100

******************************************************************************************************* 287.13-1-21 ****************

39 Lt Red Kill Rd

07802719001

287.13-1-21

210 1 Family Res

VILLAGE TAXABLE VALUE

153,300

Evans David K

Margaretville 124601 14,200 COUNTY TAXABLE VALUE

153,300

Trangco Evans Rebecca A Armstrong T Lot 25 153,300 TOWN TAXABLE VALUE

153,300

137 Florence Ave

Franklyn

SCHOOL TAXABLE VALUE

153,300

Denville, NJ 07834 FRNT 80.00 DPTH 150.00

EAST-0483448 NRTH-1210828

DEED BOOK 950 PG-106

FULL MARKET VALUE

153,300

************************************************************************************************************************************