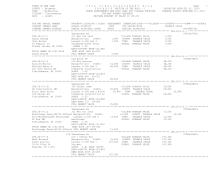

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 949

COUNTY - Delaware

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

TAXABLE STATUS DATE-MAR 01, 2016

SWIS - 124689

S W I S T O T A L S

RPS150/V04/L015

UNIFORM PERCENT OF VALUE IS 100.00

CURRENT DATE 6/28/2016

*** E X E M P T I O N S U M M A R Y ***

TOTAL

CODE DESCRIPTION PARCELS

COUNTY

TOWN

SCHOOL

47450 FOREST 480

4

1189,800

1189,800 1189,800

47460 FOREST480A

48

4991,500

4991,500 4991,500

47610 Bus Im CTS

2

142,500

142,500

142,500

T O T A L

1,137

21985,999

23387,562 53632,825

*** G R A N D T O T A L S ***

ROLL

TOTAL ASSESSED ASSESSED

TAXABLE

TAXABLE TAXABLE STAR

SEC DESCRIPTION PARCELS

LAND TOTAL

COUNTY

TOWN

SCHOOL TAXABLE

1 TAXABLE

3,524 206173,900 540659,664

530355,154 528948,847 530455,384

498708,328

3 STATE OWNED LAND 56 11928,400

11928,400

11928,400 11928,400 11928,400

11928,400

5 SPECIAL FRANCHISE 17

2524,501

2524,501

2524,501 2524,501 2524,501

6 UTILITIES & N.C. 28 25203,800

34133,015

34055,726 34055,726 34055,726

34055,726

8 WHOLLY EXEMPT 77 3518,300 11604,200

* SUB TOTAL 3,702 246824,400 600849,780

578863,781 577457,474 578964,011

547216,955

** GRAND TOTAL 3,702 246824,400 600849,780

578863,781 577457,474 578964,011

547216,955