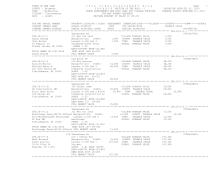

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 945

COUNTY - Delaware

WHOLLY EXEMPT SECTION OF THE ROLL - 8

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

TAXABLE STATUS DATE-MAR 01, 2016

SWIS - 124689

RPS150/V04/L015

UNIFORM PERCENT OF VALUE IS 100.00

CURRENT DATE 6/28/2016

R O L L S E C T I O N T O T A L S

*** S P E C I A L D I S T R I C T S U M M A R Y ***

TOTAL EXTENSION EXTENSION AD VALOREM EXEMPT TAXABLE

CODE DISTRICT NAME PARCELS TYPE VALUE VALUE

AMOUNT VALUE

FD121 Arkville fire 24 TOTAL

5409,300 4153,500 1255,800

FD122 Mdltwn-hrdbrgh 39 TOTAL

4572,100 4238,000 334,100

FD123 Middletown fd 14 TOTAL

1622,800 1448,500 174,300

LT418 New kingston l 1 TOTAL

385,500 385,500

LT419 Arkville light 25 TOTAL

5873,500 4617,700 1255,800

LT426 Halcot lt and 6 TOTAL

442,200 442,200

WD704 Arkville water 13 TOTAL

1456,900 1456,900

*** S C H O O L D I S T R I C T S U M M A R Y ***

TOTAL ASSESSED ASSESSED EXEMPT TOTAL STAR STAR

CODE DISTRICT NAME PARCELS LAND TOTAL AMOUNT TAXABLE AMOUNT TAXABLE

124601 Margaretville

62 3185,100 10649,600 10649,600

124802 Roxbury

15 333,200 954,600 954,600

S U B - T O T A L 77 3518,300 11604,200 11604,200

T O T A L

77 3518,300 11604,200 11604,200

*** S Y S T E M C O D E S S U M M A R Y ***

NO SYSTEM EXEMPTIONS AT THIS LEVEL

*** E X E M P T I O N S U M M A R Y ***

TOTAL

CODE DESCRIPTION PARCELS

COUNTY

TOWN

SCHOOL

12100 N.Y.S.

1

120,600

120,600

120,600

13100 COUNTY

9

127,600

127,600

127,600

13500 TOWN INSDE

8

937,700

937,700

937,700

13590 TWNOUTUSED

1

228,300

228,300

228,300

13650 VILL INSDE

3

245,200

245,200

245,200

13740 MUNI TOV

1

161,400

161,400

161,400

13890 T.I.BRIDGE

3

569,600

569,600

569,600