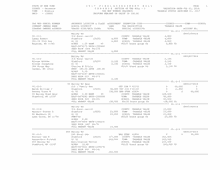

STATE OF NEW YORK

2 0 1 7 F I N A L A S S E S S M E N T R O L L

PAGE 537

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2016

TOWN - Roxbury

TAX MAP NUMBER SEQUENCE

TAXABLE STATUS DATE-MAR 01, 2017

SWIS - 124800

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 201.-3-16 ******************

Grant Morse Rd

08000945026

201.-3-16

314 Rural vac<10

CO AG DIST 41720

29,272 29,272 29,272

Morse John G

Roxbury 124802 32,300 COUNTY TAXABLE VALUE

3,028

461 Grant Morse Rd Second Div L16 Fm 4510 32,300 TOWN TAXABLE VALUE

3,028

Denver, NY 12421

Emery/john Morse

SCHOOL TAXABLE VALUE

3,028

ACRES 7.57

FD124 Roxbury fire dist

32,300 TO

MAY BE SUBJECT TO PAYMENT EAST-0477699 NRTH-1244212

UNDER AGDIST LAW TIL 2021 DEED BOOK 734 PG-821

FULL MARKET VALUE

32,300

******************************************************************************************************* 201.-3-17 ******************

664 Grant Morse Rd

08000945026

201.-3-17

210 1 Family Res

COUNTY TAXABLE VALUE

410,200

Steinfeld Jacob

Roxbury 124802 46,600 TOWN TAXABLE VALUE

410,200

Orpin-Steinfeld Mercedes Second Div L17 Fm 4510

410,200 SCHOOL TAXABLE VALUE

410,200

8 Spruce St Apt 55T ACRES 5.14 BANK 04

FD124 Roxbury fire dist

410,200 TO

New York, NY 10038 EAST-0477930 NRTH-1244548

DEED BOOK 1327 PG-108

FULL MARKET VALUE

410,200

******************************************************************************************************* 201.-3-18 ******************

Grant Morse Rd

08000945026

201.-3-18

314 Rural vac<10

COUNTY TAXABLE VALUE

32,200

Pine Street, LLC

Roxbury 124802 32,200 TOWN TAXABLE VALUE

32,200

230 Waverly Ave

Second Div L18 Fm 4510 32,200 SCHOOL TAXABLE VALUE

32,200

Patchogue, NY 11772 John/emery Morse

FD124 Roxbury fire dist

32,200 TO

ACRES 7.56

EAST-0478165 NRTH-1244816

DEED BOOK 1313 PG-203

FULL MARKET VALUE

32,200

******************************************************************************************************* 201.-3-19.1 ****************

Grant Morse Rd

08000945026

201.-3-19.1

312 Vac w/imprv

COUNTY TAXABLE VALUE

29,400

Insana Anna

Roxbury 124802 27,100 TOWN TAXABLE VALUE

29,400

230 Woodridge St

Second Div L19 #5098 L-1 29,400 SCHOOL TAXABLE VALUE

29,400

Wood Ridge, NJ 07075 ACRES 5.90

FD124 Roxbury fire dist

29,400 TO

EAST-0477771 NRTH-1243145

DEED BOOK 1239 PG-141

FULL MARKET VALUE

29,400

******************************************************************************************************* 201.-3-19.2 ****************

152 Morse Farm Rd

08000945026

201.-3-19.2

210 1 Family Res

COUNTY TAXABLE VALUE

334,000

Richards Huw Boston Roxbury 124802 47,600 TOWN TAXABLE VALUE

334,000

Richards Allison Laney Second Div L19 #5098 L-2 334,000 SCHOOL TAXABLE VALUE

334,000

24 W 69th St Apt #5-B ACRES 6.15 BANK 4317

FD124 Roxbury fire dist

334,000 TO

New York, NY 10023 EAST-0478245 NRTH-1243123

DEED BOOK 1419 PG-152

FULL MARKET VALUE

334,000

************************************************************************************************************************************