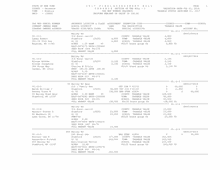

STATE OF NEW YORK

2 0 1 7 F I N A L A S S E S S M E N T R O L L

PAGE 528

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2016

TOWN - Roxbury

TAX MAP NUMBER SEQUENCE

TAXABLE STATUS DATE-MAR 01, 2017

SWIS - 124800

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 201.-1-58 ******************

759 Howard Greene Rd

08001032026

201.-1-58

210 1 Family Res

COUNTY TAXABLE VALUE

113,600

Mazzucco Joseph S Roxbury 124802 38,400 TOWN TAXABLE VALUE

113,600

344 Pudding St

Gl19 Div 1 Lot 2

113,600 SCHOOL TAXABLE VALUE

113,600

Carmel, NY 10512

Fred/irene Schepis

FD124 Roxbury fire dist

113,600 TO

ACRES 5.60

EAST-0475812 NRTH-1241772

DEED BOOK 670 PG-678

FULL MARKET VALUE

113,600

******************************************************************************************************* 201.-1-59 ******************

831 Howard Greene Rd

08000524026

201.-1-59

210 1 Family Res

COUNTY TAXABLE VALUE

97,500

Mazzucco Joseph S Roxbury 124802 42,200 TOWN TAXABLE VALUE

97,500

344 Pudding St

Gl19 Div 1 Lot 2

97,500 SCHOOL TAXABLE VALUE

97,500

Carmel, NY 10512

Lena S Greene

FD124 Roxbury fire dist

97,500 TO

ACRES 6.30

EAST-0476028 NRTH-1241926

DEED BOOK 604 PG-320

FULL MARKET VALUE

97,500

******************************************************************************************************* 201.-1-60.1 ****************

983 Howard Greene Rd

08000177026

201.-1-60.1

210 1 Family Res

ENH STAR 41834

0 0 65,500

Stafford Michael

Roxbury 124802 37,100 COUNTY TAXABLE VALUE

97,800

Stafford Sherry

Gl19 Div 1 Lot 2-38 97,800 TOWN TAXABLE VALUE

97,800

983 Howard Greene Rd ACRES 4.78

SCHOOL TAXABLE VALUE

32,300

Denver, NY 12421

EAST-0476818 NRTH-1242339 FD124 Roxbury fire dist

97,800 TO

DEED BOOK 1396 PG-18

FULL MARKET VALUE

97,800

******************************************************************************************************* 201.-1-60.2 ****************

Howard Greene Rd

08000177026

201.-1-60.2

322 Rural vac>10

COUNTY TAXABLE VALUE

68,400

Cole Jennifer

Roxbury 124802 68,400 TOWN TAXABLE VALUE

68,400

300 East 93rd St Apt 27D Gl19 Div 1 Lot 2-38 68,400 SCHOOL TAXABLE VALUE

68,400

New York, NY 10128 FM 4466

FD124 Roxbury fire dist

68,400 TO

ACRES 40.91

MAY BE SUBJECT TO PAYMENT EAST-0475574 NRTH-1242929

UNDER RPTL480A UNTIL 2026 DEED BOOK 1239

PG-159

FULL MARKET VALUE

68,400

******************************************************************************************************* 201.-1-61 ******************

863 Howard Greene Rd

08000454026

201.-1-61

240 Rural res

COUNTY TAXABLE VALUE

501,400

Strutt Stephen

Roxbury 124802 117,500 TOWN TAXABLE VALUE

501,400

724 Titicus Rd

Gl19 Div 1 Lot 2-38 501,400 SCHOOL TAXABLE VALUE

501,400

North Salem, NY 10560 ACRES 99.00 BANK 45 FD124 Roxbury fire dist

501,400 TO

EAST-0473727 NRTH-1243389

DEED BOOK 1140 PG-107

FULL MARKET VALUE

501,400

************************************************************************************************************************************